estate tax return due date canada

January 1 to October 31 of the year. Filing for 2021 individual tax returns is open until May 2nd 2022.

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

If the death occurred between Nov 1 st to Dec 31 st the due date is 6.

. March 31 is one tax filing deadline that is often. Be aware of deadline for filing estate tax returns If a family member died last year file the necessary income tax returns on time. When planning your estate you want to make sure your wishes will be carried out.

Dont forget to consider the taxes payable at death. An estate tax return is usually filed nine months after the death of an estate owner. Its due six months after death for deaths from Nov.

Register file and pay gst or hst in canada. If the death occurred between November 1 and December 31 inclusive the due date for the final return is 6 months after the date of death. Before a six-month extension is given and after the exact taxpayer amount is determined the.

Beginning January 1 2020 an Estate Information Return must be received by the Ministry of Finance within 180 calendar days of the date the estate certificate was issued. Graduated Rate Estate GRE due date is 90 days from the date of final distribution. Any taxes owing from this tax return are taken from the estate before it can be settled dispersed.

Chart indicating the due date for the final return based on the date of death. Depending on the type of trust the due date of the final trust is one of the following. If the death occurred between January 1st and October 31st you.

13 rows Due Date for Estate Income Tax Return. Each type of deceased return has a due date. If the deceased or the deceaseds spouse or common-law partner was carrying on a business in 2021 unless.

13 May 2021 by National Bank. Filing return Terminal tax return Final income tax return If the deceased died on or before October 31 st then the terminal tax return is due April 30 th of the following year. If death occurs between January 1 and October 31 the final return is due by April 30 of.

If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year. April 30 of the. If the death occurred between Jan 1 st to Oct 31 st the due date is April 30 th of the following year.

Period when death occurred Due date for the final return. The due date for the final T1 return and the tax payments depends on the date of death. Most taxpayers are expected to send their submissions by April 30th of each year.

For individuals the tax year is the same as the calendar year and the T1 is due April 30 for deaths before Nov. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets. Estate tax return due date canada Saturday May 28 2022 Edit 31 year-ends that makes the T3 filing deadline March 31 March 30 in leap yearsdifferent than the more familiar.

February 28 29 June 15. Report income earned after the date of death on a T3 Trust. Due dates for the estate tax return are nine months after the death date of the decedent but if the estate wishes to extend the filing time for up to six months it can do so.

The due date of this return depends on the date the person died. Final return For a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts wind-up discontinuation date. When are the returns and the taxes owed due.

If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. Estates and trusts must file a tax return if they generate over 600 in gross income per year. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

If you wind up an inter vivos trust or a testamentary trust other than a graduated. The estate T3 tax return reports income earned after death. The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between.

If the date happens to be on.

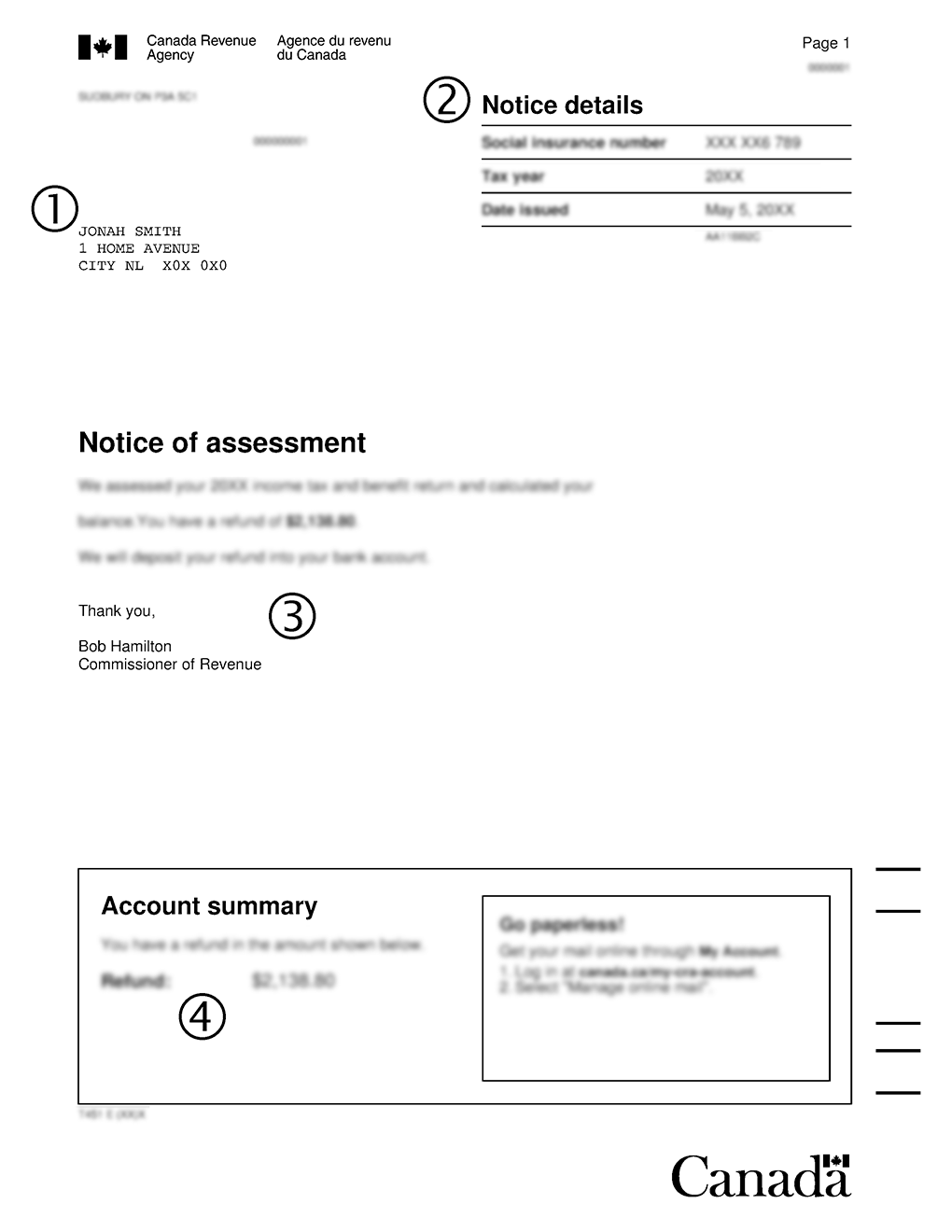

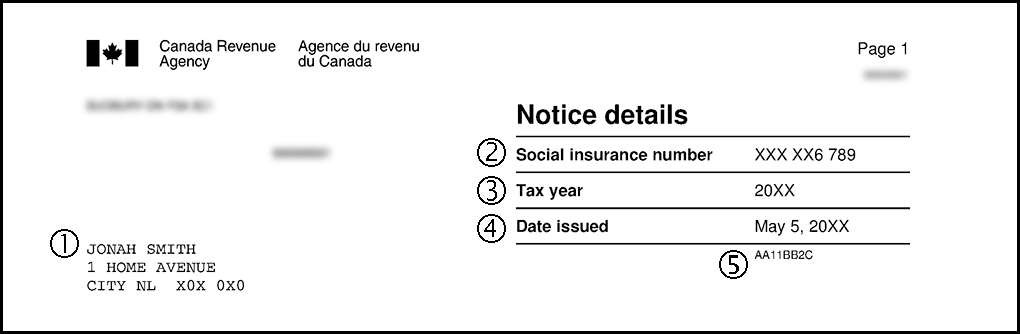

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Personal Income Tax Brackets Ontario 2020 Md Tax

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

When Can I File My 2021 Taxes In Canada Loans Canada

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

How Estate And Inheritance Taxes Work In Canada

Income Tax Filing Is It Compulsory To All Capital Gains Tax Estate Tax Money Market

Cra T1135 Forms Toronto Tax Lawyer

Canadian Tax Return Deadlines Stern Cohen

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

How Canadian Inheritance Tax Laws Work Wowa Ca

How Estate And Inheritance Taxes Work In Canada

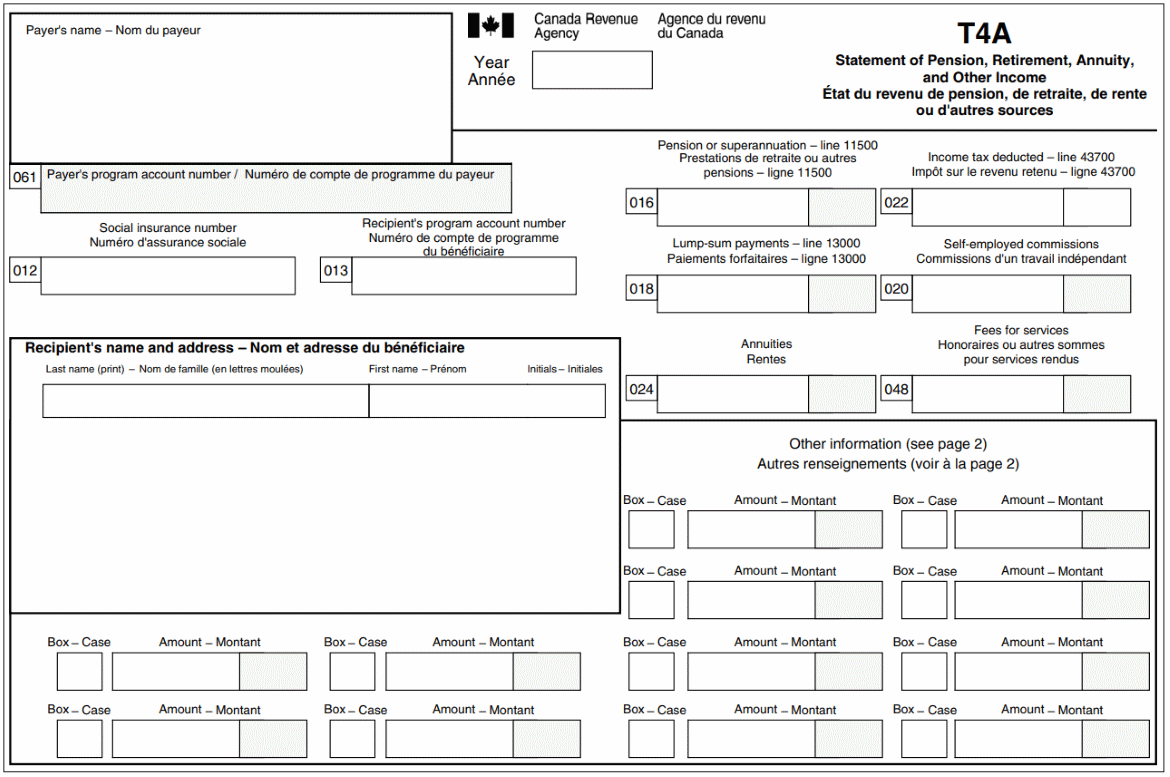

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

When Can I File My 2021 Taxes In Canada Loans Canada

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca